Venture funding start-up dilemma: a VC perspective

Often we engage with a founder who has bootstrapped the company to USD 1-1.5m in ARR in revenue, doesn't burn any money and starts to ask themselves a question:

Should the company raise VC capital to spur growth?

There is never a right answer as it comes with a cost of dilution to founder and there’s always an excel spreadsheet to go either way.

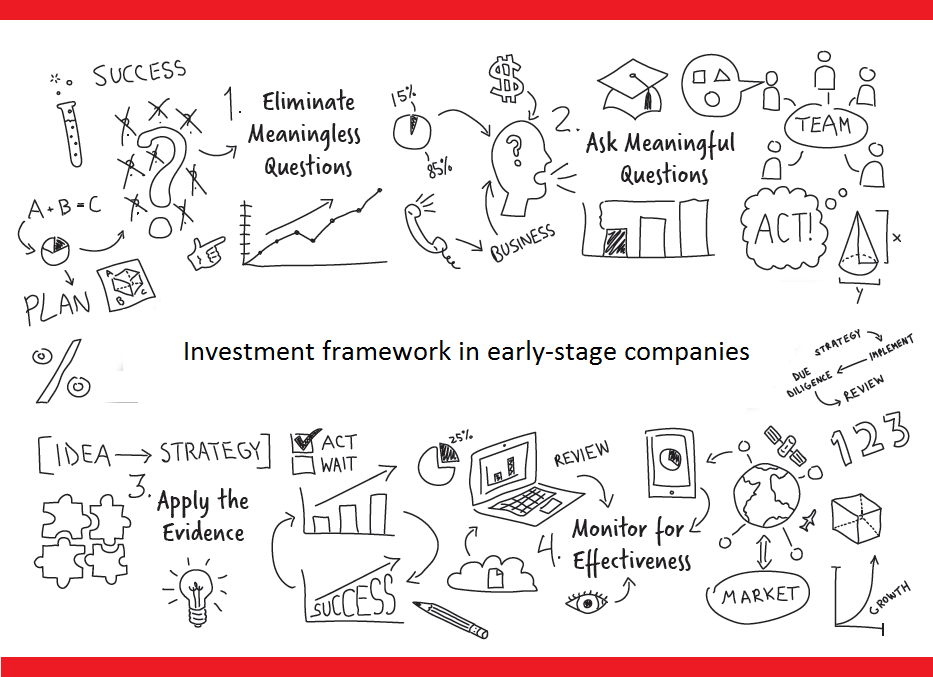

Here are some considerations founders of early-stage companies should keep in mind when deciding:

The pro's:

Raising capital creates a momentum across various layers.

-

Team (both among existing members and new hires):

The biggest asset of any start-up is a talented team behind it. By raising capital, you are signaling a potential new A-player hires they are missing out in ambitious career path. For existing employees, especially the ones holding ESOPs, it creates more loyalty and indicated they've chosen the right boat to be on.

-

Clients:

Every segment has some level of competition and every opportunity should be used to differentiate the company vs the competition. By showing VC's invested into your company (especially if they are industry focused) you are confirming that the team and the product have great value and VC's bet their money on it. It also states the company is financially sound, at least for the time being.

-

Founder:

Building a startup is a marathon and even though raising money isn’t a successful outcome and is just another kilometer on the long journey, a successful fundraising acts as a quick win and shows short-term success.

And of course having few more million in the bank account helps to better sleep at night.

-

Industry:

VCs invest in new trends and innovative business models where large markets are born. Having a sound pack of credible investors behind shows potential buyers of a new market opportunity and could ease the exit process.

The con's:

Despite some clear benefits of having more capital to spur growth, there are some important tradeoffs the founders will face:

-

Dilution

Most VC rounds take about 20-30% of the company. If the company ends up raising several rounds of capital the Founder's ownership at the time of an acquisition can down to single - low teens. There is nothing wrong with it, as long as the company is worth a billion dollars due to extensive financing.

7% ownership of a USD 1 bn dollar public company is economically a better situation than 100% of a USD 20 mln.

-

Reduced flexibility.

By bringing a VC onboard, some decision-making flexibility is stripped away. Operational aspects are still maintained by the Founders, yet more strategic decisions are now approved bilaterally and often you need to spend your time to persuade them it is the right thing to do.

In many cases, though, a VC does bring industry expertise and allows to entrepreneur not to make the same mistakes.

-

Increased transparency

The asymmetry of information is always an issue. Every investor wants complete transparency on how things run. Dealing with more than 2 VCs can become a tenacious task and could require additional hiring.

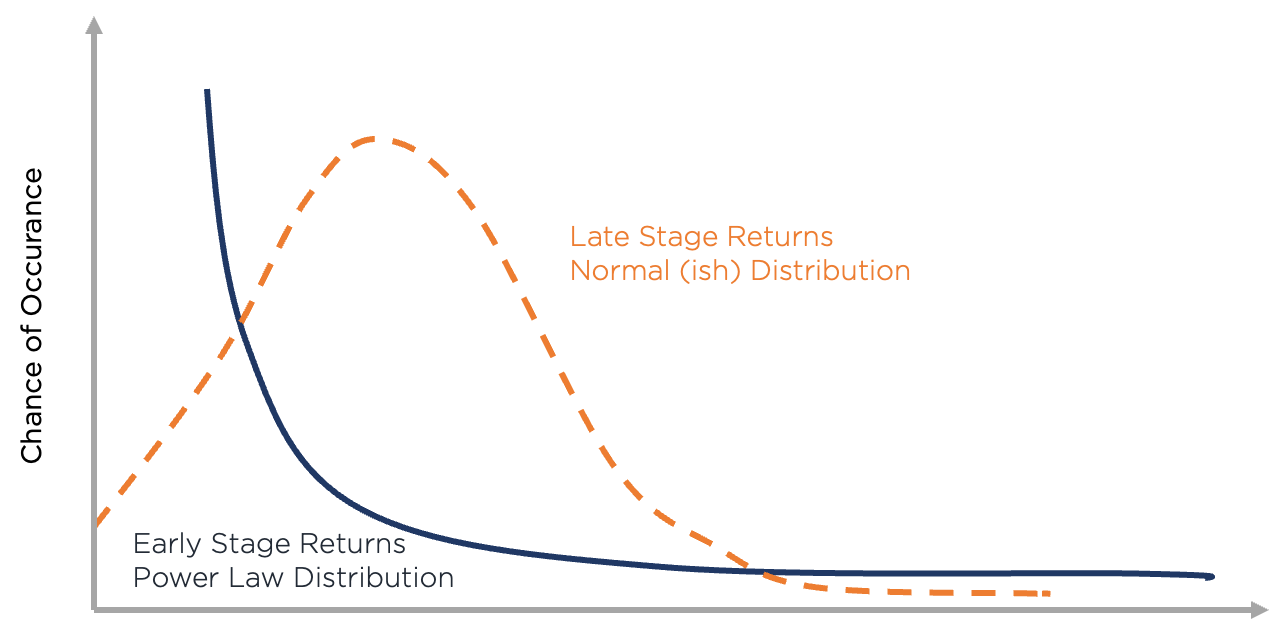

- Exit lock-up

VCs want big exits: 5-10x on their investments. By taking VC capital, in most cases, the quick timing of an exit at a small valuation is out of the picture. If you ever get tired and want to move on yet still control the direction where the company is heading you need drive revenue to a substantial revenue before an external CEO could take your place.

All in all:

The best advice to give here is that if you decide to raise capital, or raise additional rounds of capital do it when things are not just good, but are great and getting better and have a clear understanding why you are raising.

Don't wait another few quarters to maximize short-term revenue. The obstacle will always be around the corner: be it another crisis, an aggressive competitor taking your market share or major client decided to leave you.

By losing the momentum, you may not get it back.

A.