How does a VC investor value an early-stage company?

One of the most asked questions from pitching start-ups is how do we arrive a the valuation of the companies we invest in?

Before we dive in deeper, let's quickly walk through the VC's business model.

Here's the simplified version:

Step 1. Invest US$ X mln @ a pre-money valuation of US$Y mln

Step 2. Sell the company for US$ Z mln after years/decade.

By investing US$ X mln @ US$ Y mln the investor's ownership leads to S = X / (Y + X), conditional no dilution happens along the way.

Simply put: if Z * S > X * N, where N >> 1, you've done your job well, the initial investment got multiplied and made the fund's investors happy. N is typically called the money multiple

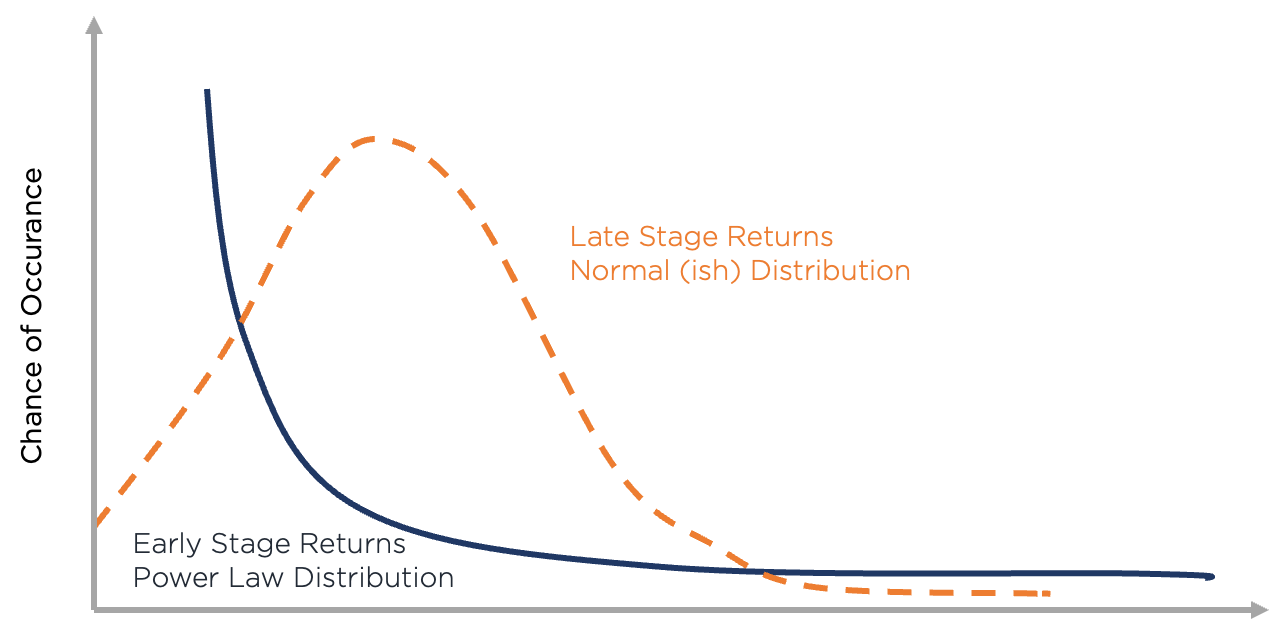

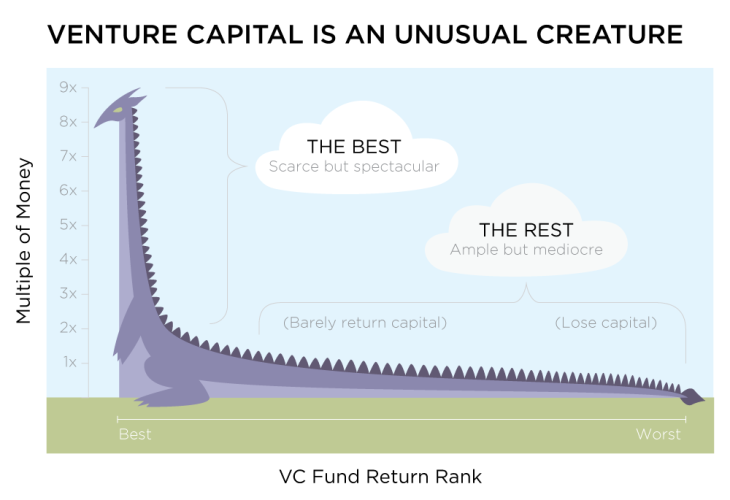

Even though the business model sounds rather simplistic here's how the VC industry in the US has performed since 1989 to 2010. Only a dozen or so funds were able to show consistent returns which beat the equity market.

The equation above runs on 3 variables:

- Size of the investment (or round size)

- Pre-money valuation

- Exit valuation

There is also a fourth variable, the dilution effect of the initial ownership due to further company fundraising, but we'll leave it for now.

Size of the investment:

The size of the round is usually pre-defined by the current stage of the company. In the software space:

- Seed rounds range up to US$2m

- Series A rounds range from US$3m to US$10m

- Series B rounds range from US$5m to US$15m etc..

The round size in any given class surely differs by company's industry and sector, but the investment is typically enough to get the company to its next milestone.

In reality, the size of the round is typically determined by the entrepreneurs to execute their desired strategy rather than by VCs .

Exit valuation:

The exit valuation is another variable that is out of VC control for several reasons:

VCs exit either through an M&A or an IPO. In either case, you are usually bought for a combination of a set of financials and a technology, rarely for just one of them. The price different buyers will pay varies greatly (case: Viber vs WhatsApp exit, similar size assets, 20x difference in exit valuation).

The deciding factor when to sell the company is also mainly at the hands of entrepreneurs, by exiting too early VCs lose the opportunity to allocate more capital at reduced risk rates. In some cases when the business is not doing too well and VCs already spend too much capital, there could be a decision to hedge and exit to another PE fund, but in such a case VC most likely already lost on its investment.

This brings us down to the last parameter.

Pre-money valuation:

The traditional valuation methods are well described here and include the following:

- Discounted cash flow

- Cost based approach

- Comparable company analysis (both M&A and public markets)

- or more sophisticated OPM explained here

All of the above work great on established companies with more or less forecastable P&Ls.

In the VC industry, the first and second approaches aren't very appropriate:

- Almost all start-ups have a negative FCFF for foreseeable future, unclear target EBITDA margins, and futuristic costs of capital.

- For the past few decades, the cost to start a technology company has been reduced by almost zero (except for the developer's time) so the cost-based approach isn't really an insightful exercise.

- Option price model can be used, but as Mark mentioned is not very transparent pricing both to a VC and Founders.

So, in reality, it only leaves comparable company analysis.

Comparable company analysis.

The are 2 ways to go here, which basically depend if the company turning its monetization switch.

Bottom-up [Switch is OFF]: Most consumer-focused start-ups show a great deal of traction in terms of its usage, but lack any proven monetization abilities.

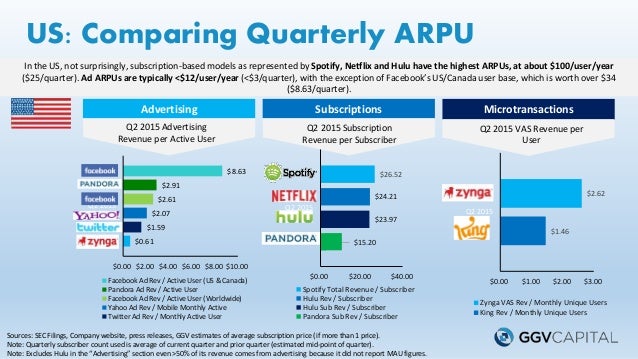

The general approach to calculating revenue potential is the following: US$ X /user/annum * Y people. The more daily engagement the product has the higher X will be.

Such an approach is also applied to the product's region as the numbers could greatly differ across the globe: from >US$10 in the USA vs ca. US$1 in rest of the world.

In the case of Twitter, despite the daily time spent on the app being similar to Facebook, Twitter's revenue is almost 2.5x less due to media real estate being utilized much less.

Basically, it all depends on the website's ability to retain user's attention:

The base scenario to assess the advertising monetization potential of a start-up is to use ARPU in a range of USD 1-2 per annum per active user.

Subscription services are harder to believe in as there is just no churn stats, so even if we believe the product is appealing to its audience, we would use only a small percent of it with a low LTV from such a subscriber.

- Top-down [Switch is ON]: Company showed its ability to monetize and some multiple quarter run-rate. When the company has turned its switch, it is almost impossible to switch it back OFF, the results from now on will be assessed purely on monetization.

The goal of the exercise is to assess how the industry is valuing specific verticals and apply a similar multiple to the start-up revenue adjusted for growth. It varies greatly even within specific industries, yet still gives a good indication on where the public market perceives the fair value of an asset.

All in all: the dark side of the valuation

With all being said, given the vast amount of input parameters how do you come up with a number when you are ready to bid?

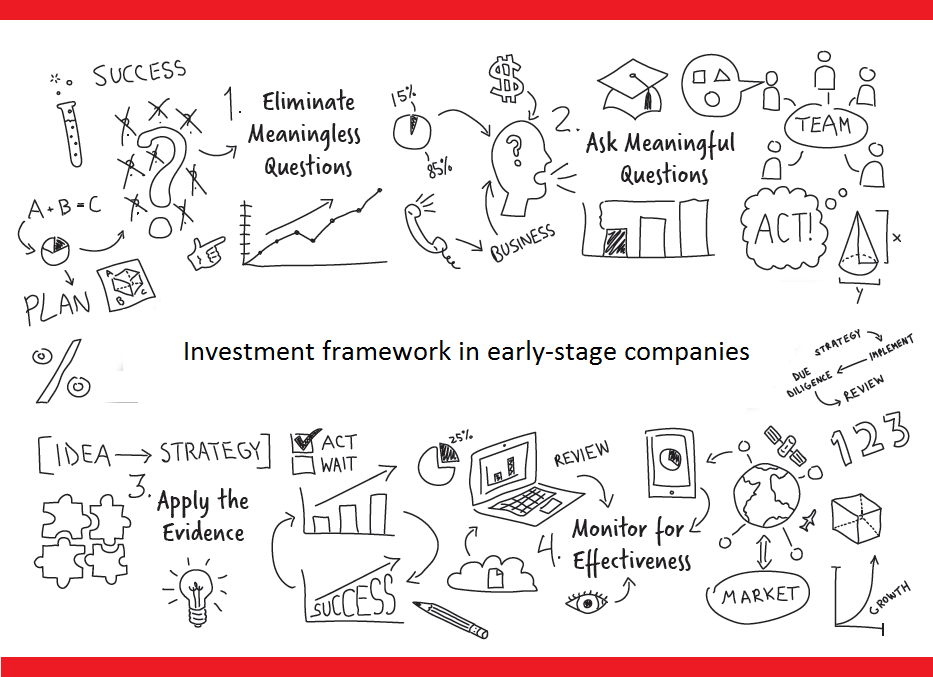

Step 1: Assess where the company's revenue will be in 5-7 years if everything goes according to plan.

Step 2: Use today's broad industry multiple to estimate how much such a company can be worth as the start-up will grow and matures. Future deterioration on the multiple should be considered here.

Step 3: Calculate the present value of such an Exit.

Step 4: Compare the value from step 3 with today's run-rate / potential revenue numbers with today's industry multiple.

If the numbers in Step 4 are +/-20%, most likely it is being fair.

So here is an example:

Consider a company with USD 3m in revenue in an enterprise software business growing 3x in the last two years.

Step 1: The believable base plan is to triple, double, double and grow by 50% after which the grow subsidies, so in 4 years the company will have an estimate of = 3 * 3 * 2 * 2 * 1.5 = USD 50 m in revenue.

Step 2: Established enterprise businesses with slower growth are traded at 3 P/S, so this gives an Enterprise Value of USD 50*3 = USD 150m.

Step 3: VC fund's risk profile is to make 3x net return on initial capital, so with some investment to hit rock bottom, the initial target is to return at least 5-10x which is equivalent to a target IRR of 50-80% over that year period.

The PV (Present Value) = EV [T+4] / (1+IRR)^4 ~ = USD 150m / (1+75%)^4 = USD 150m / 9.4 = USD 16 m pre-money valuation.

Such a scenario excludes the dilution due to further funding being raised to achieve such growth. So if in a likely scenario a couple more rounds of capital are required, the stake would be diluted by another 30-40% and the valuation would go down to ca. US10 mln.

Step 4: Based on today's revenue we arrive at a range of USD 10 - 16m or 3.3 - 5.3 based on the current revenue multiple. There are a few factors which could offset the by a premium or a discount.

- Superior growth vs early stage companies peer-group

- Vibrance of the market. How hyped is it?

- Quality of the founding team

- Operational liquidity of the company

- Ability and willingness to further fundraise

- Supply and demand of the deal today

Valuing an asset looks like an art and it is with a little bit of math and probability theory in it. The fair price of an asset is what the market perceives it to be, so if a start-up company received an offer, that's where the market is. During fundraising, the market can be either many bids from one fund or a bunch of bids from many. It's up to the founder to create market liquidity for his asset via a compelling story and actual results.

A.