Nail it then scale it: growth vs CLTV-CAC excel template

Despite all available resources (tons of open-source, cloud IaaS, testing tools etc) it is still much harder to build a SaaS than a marketplace. With marketplace to start getting first traction all you need is a few landing pages, an advertising budget for facebook / google, if there is a need to your product, the rest eventually will be developed.

With SaaS companies it quite the opposite, there is:

- longer time need to design the product

- longer onboarding time (in b2c many times the purchase itself is irrational, with b2b it is much more rational as requires >1 person's approval)

- more expense to acquire customers

What makes it worse is trying to scale before you were ready to so.

Let's break-it down why is so:

Let's image an early stage SMB / lower mid-market SaaS company that has:

- first hundred customers

- Annual contract Value (ACV) somewhere in between a mice and a deer in Christopher's methodology

- Found scalable channel allowing add more new customers each quarter with double digits q-o-q growth

- Constant COGS

- Fixed cost in GA and R&D to support a team of couple a dozen employees

How aggressive should S&M be to gain market share?

To answer this question founder or CEO needs to understand efficiency in several components of customer lifetime value (CLTV) / CAC ratio.

Let's quickly recap.

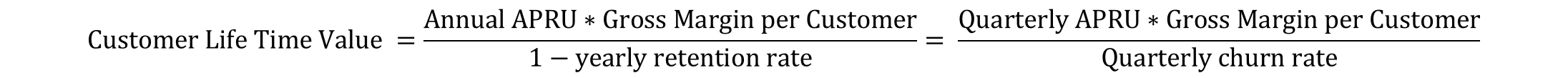

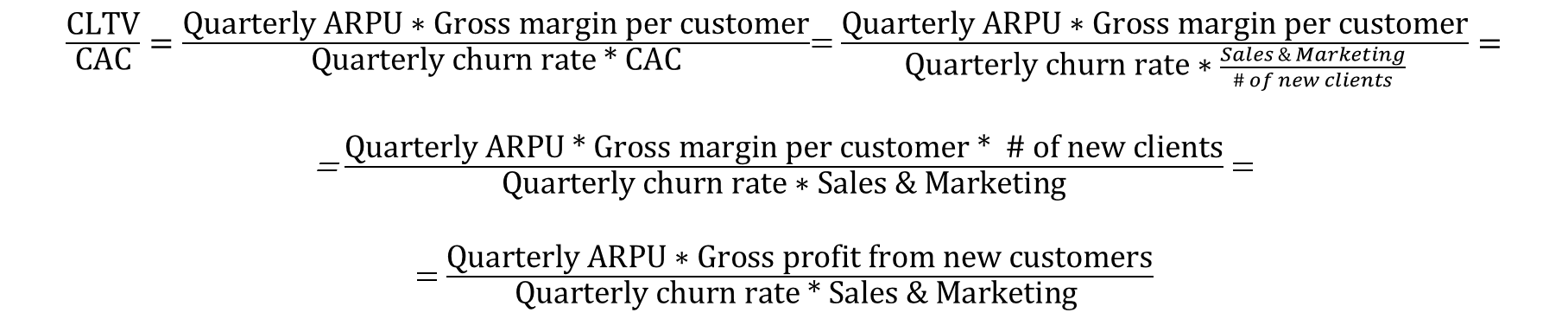

To estimate CLTV, we take gross contribution and retention are generally fixed across periods after fist month of drop (we will drop this for now). In such a case CLTV it can be expressed as a simpler model assuming an infinite economic life (N-> infinity).

So, CLTV in case of 15% annual churn would be:

$25,000 = $5 000 annual contract value * 75% margin ÷ 15% annual churn.

The next step would be to understand how the relationship between sales and marketing and CLTV / CAC ratio.

CLTV / CAC ratio consists of 4 components:

- ARPU or annual contract value

- Gross margins per customer

- Client churn

- Customer acquisition cost (CAC)

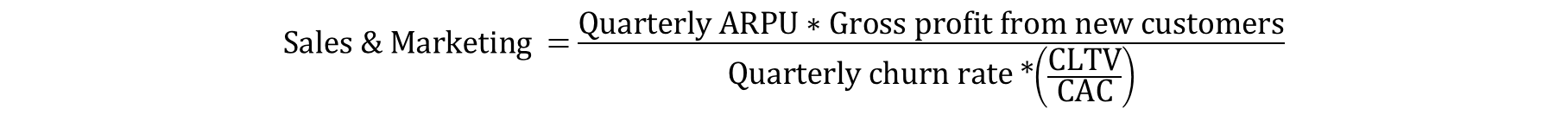

since we are trying to understand how much we should be spend in marketing:

Let's create an excel template modeling how much funding required to scale such business as well create sensitivity analysis for growth vs CLTV/CAC ratio:

DOWNLOAD GROWTH VS CLTV TO CAC EXCEL TEMPLATE

Initial inputs:

- C5: Initial number of new customers

- C6: Growth of new customers Q-o-Q (for simplicity growth of new customer remains constant)

- C8: Annual Contact Value (ACV), for quarterly need to divide by 4

- C9: Annual Churn, to get quarterly churn = (1 + Annual churn)^(1/4) - 1

- C38: COGS as % of revenue

- C44: CLTV / CAC ratio, for simplicity purposes CLTV / CAC ratio remains contact across all period, which is rarely the case

- C46, C48: Initial R&D and G&A

Modeled variables:

- Row 3: Number of customers as sum of client cohorts from Row 12-31

- Row 4: Active customers as % total signed, shows how much potential market opportunity can capture (a churn of annual 30%, even with more than doubling of # of clients would mean a 1/4 of the market is unattainable, if growth of new customers slows in later years, then level of reachable market share is even lower).

- Row 5: Number of new customer after first quarter

- Row 12 - Row 31: cohorts remaining customers from any given month

- Rows 34-35: Revenue (all/new), number of customers * quarterly ARPU

- Row 39: Gross profit = Revenue - Cost of Sales

- Row 42: Sales & Marketing is calculated based on defined above formula as f(gross profit from new customer, CLTV/CAC ratio and quarterly churn)

- Rows 46, 48: R&D and G&A as initial C46, C48 growing at 5% per quarter

As a result in C53 we calculated minimum funding required to get to break-even (in reality you need 2-3x of that number)

Sensitivity analysis for capital required to scale:

Our initial question was: How aggressive should it push S&M to gain market share?

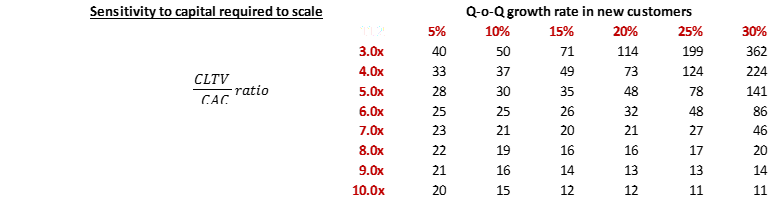

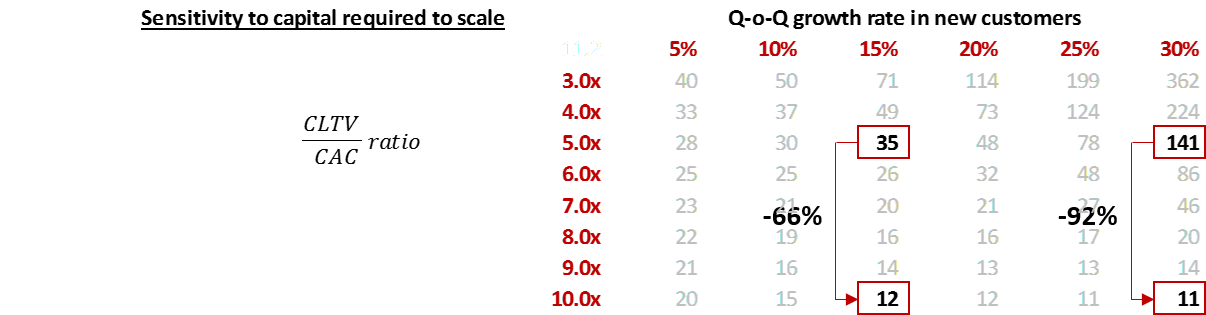

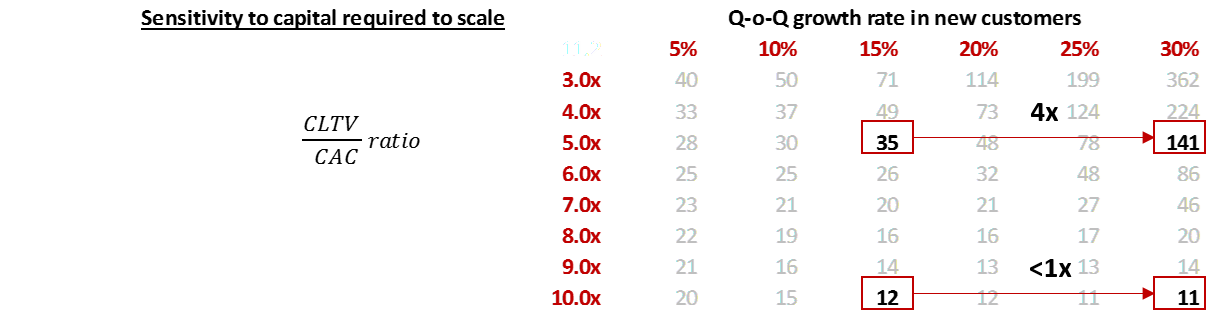

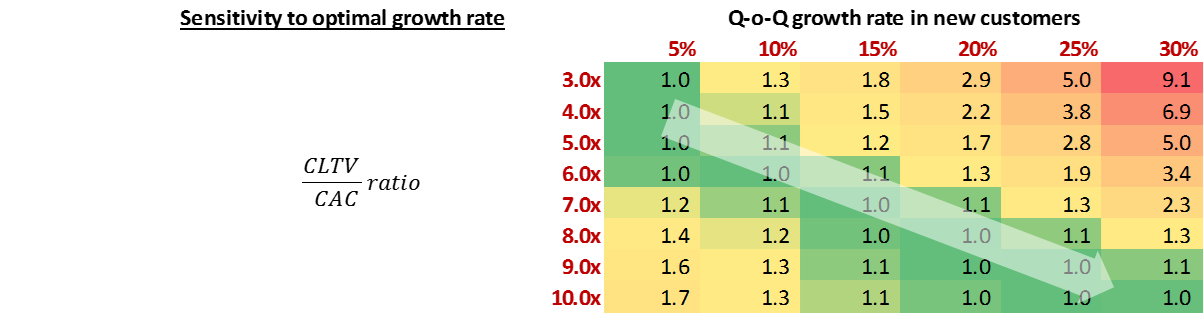

The first thing we want to understand is the difference in amount of capital required to scale business model based on how efficient are overall sales & marketing for our product vs different growth rates:

Chart below shows such dependence based on our model:

From the chart above we can observe several trends:

Trend 1: Comparing amounts of capital needed to scale varies half the magnitude: from low teens when LCTV / CAC approaches 10x vs dozens to hundreds of millions when equal or below 5x. This means founder's share will be dramatically diluted to <15% by the time the company reaches 8-9 figure revenues.

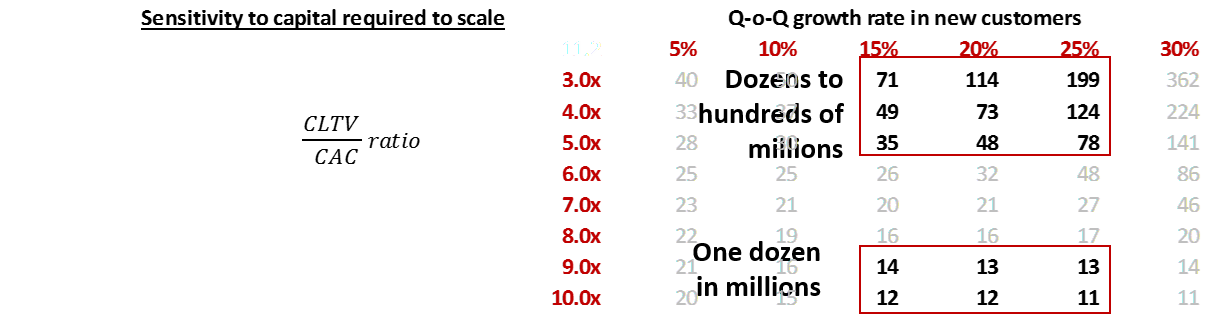

Trend 2: doubling in scaling efficiency (CLTV / CAC) from 5x to 10x, reduces by the 2/3 amount of required capital at Q-o-Q growth rate of new customer at 15%. Doubling Q-o-Q growth rate to 30%, the difference in required funding on the same scaling efficiency would be over 10x.

Trend 3: capital required increasing Q-o-Q growth rate at given CLTV / CAC ratio also varies greatly: from 4x when scaling efficiency is at 5x to <1x when CLTV / CAC ratio goes to up to 10x. This might sound a bit strange, but what this means is at a high values (>=10x) of scaling efficiency it is more economically from funding perspective to increase spend in sales and marketing to grow faster to offset fixed costs.

Trend 4: Optimal point which requires the minimal amount of funding at any given scaling efficiency moves to the right in terms of Q-o-Q growth rate. White arrows shows how point of minimum required fundraising move to higher growth rates as scaling efficiency increases. This is a more general observation then we what we described as part of trend 3 when at scaling efficiency of 10x company required less capital to grow at 30% growth rate than at 15%. In essence this means that prematurely pushing aggressive growth will require much more capital and thus heavy dilution for founders.

So, what are some real life example based on the above and practical implication one can take. In order to nail scaling, you need to focus not just on client churn, but getting overall CLTV / CAC to a high number and there are few way to do so:

-

minimize churn: CLTV / CAC has an inverse dependence on churn, reducing churn from 20% per annum, to 10% will would double your ratio. Best case scenarios is to have zero to negative client churn.

-

improve sales and marketing: CLTV / CAC has also an inverse dependence on CAC, so decreasing cost per adding client several time means will significantly boast scaling efficiency. Part of it is to build a self-serve model to reduce amount of direct sales and only focus them on bigger fish.

-

increase gross profits: increase gross profit margin is touch as in usually COGS is a variable cost which are hard to reduce, but decreasing COGS few percentages will increase scaling efficiency by about the same amount. Unless COGS are over 40%, this is the last variable to optimize especially at early stage.

-

increase quarterly ARPU: product changes or finding channel with better sales & marketing economic might be take some time to tackle, changing price strategy can be don quickly, this usually either mean repositioning a product or start nailing bigger clients.

To give a high level example there are few companies that nailed scaling efficiency and become huge businesses:

-

Zendesk & New Relic each have a significant negative churn, which allows to offset in dollar terms the drop in clients.

-

Atlassian had 0 sales people when it filled S-1 vs the general SaaS industry which spend from 30-100% of its revenues while going public. This was possible due to self-service product capabilities. It was privately got to 9-figure revenues.

-

Veeva had achieved efficient scaling by only going to high-end enterprise client only with an average ACV of nearly a $1 million and raised only $7 million of capital till IPO.

There are different ways to scale the business to get to 9-figure revenues, it is up to you to choose your own strategy, but best to keep in mind that scaling before nailing will significantly dilute you.