SaaS Magic Number: measuring scaling efficiency

Tons of metrics can be calculated for any SaaS business. In order to determine how your start-up is performing in a business environment, it's essential to calculate the SaaS Magic Number and various other sales efficiency metrics. Although the metric is overlooked in the SaaS startup community, it’s no secret that SaaS Magic number is one of the most important ones when you are looking to raise your next investment round.

What does the SaaS Magic Number metric tell you about the business?

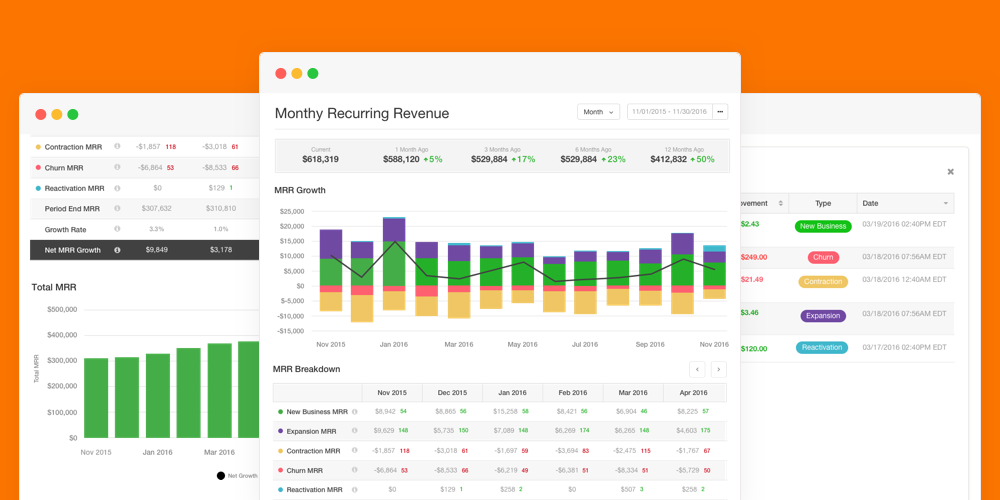

For starters, the SaaS Magic Number is a sales-related SaaS metric helpful in determining a start-up's competence in generating incremental periodic revenue. Calculating the SaaS magic number helps you understand how capital-efficient the business is, as well as the growth sustainability of your sales and marketing in a competitive market. There are two factors that are taken into consideration to figure out how efficiently money is being spent in growing the business:

- Spend on sales & marketing

- Growth in recurring revenue

In this blog post, not only will we take a look at why SaaS Magic Number holds real importance, but we will cover how to calculate it and better understand your company scalability.

Why is the magic number important?

Company finances are important to business operations, but investors also want to know how different metrics, in all facets, play out. The more control and understanding the founder has over its metrics, the more leverage he'll have in isolating company bottlenecks. While running a SaaS business you have to keep track of all the details, so magic number is important to your sales efficiency for various reasons:

Calibration: No SaaS business strikes out into an industry and reaps all of their consumers within a single attempt. Marketing requires adjustments and recalculations. Knowing your SaaS magic number calibrates your work toward better sales and marketing solutions.

Sales Redesign: The specific areas that you need to improve in can be determined by a simple metric. What you have to ultimately figure out is when and where discrepancies are occurring. You can then target those areas and polish them up.

Cost Reduction: When you are succeeding, the numerical figures you receive reveal where costs can be reduced. This starts with knowing the scalability of your magic number and why.

Staff Education and Training: Sales enablement is a process that equips your SaaS staff with the tools they need to operate an entire sales funnel. The more that you know about the health in each part or stage, the better you can train and prepare your sales reps with data-driven DNA.

How To Calculate The Magic Number?

The SaaS Magic Number effectively measures the output of a year’s worth of recurring revenue growth for each and every dollar disbursed on sales and marketing activities. It takes into account the recurring revenue growth and expenditure on sales and marketing to quantify how effectively the money is spent to develop your business. The result's in the form of a number, and when it amounts to 1 or more, then it must be considered ideal.

- If the number is more than one, then you consider investing more in sales & marketing.

- In case it’s less than one, you are better off focusing on making the sales and marketing strategy more effective.

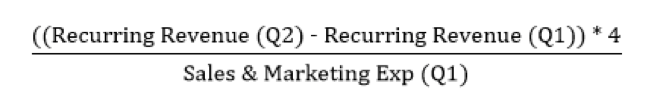

The magic number can be calculated by using the current quarter new recurring revenue annualized, divided by previous quarter sales and marketing expenses. Here’s the SaaS magic number formula:

Let's review an example to give more color.

Let’s assume that a company witnessed a recurring revenue of $2.4 million during Q2 and $1.2 million in Q1 with $4 million expenses in sales and marketing. Calculating the magic number using the formula above, the result turned out to be 1.2.

((2,400,000-1,200,000) * 4) / 4,000,000 = 1.2 (Magic Number)

SaaS Magic Number benchmarks

Fetching a SaaS Magic Number of 1 or more is always considered ideal because it indicates the efficient functionality of the business in the market.

However, if the magic number turns out to be less than 1, then it’s time to realize that the customer acquisition techniques of your business are insufficient.

There are certain good means of tackling these issues such as improving the return on investment of your sales and marketing processes or cutting the business costs.

- If the ratio is between 0 and 0.5, then the business should ideally focus on better sales efficiency.

- With the ratio being between 0.5 and 1, it is mostly accepted by investors for further capital efficiency.

- Lastly, if the ratio is 1 or more then it indicates sturdy sales efficiency and a capital-efficient growth model.

An attempt to turn your low Magic Number into a higher one will absolutely offer you the chance to discover new and more cost-effective client acquisition strategies. It is recommended to move towards content marketing as an efficient strategy for a subscription business as the initial investment will definitely continue to reap beneficial returns over time.

The growth in recurring revenue is a function of 2 parameters:

- growth in new bookings

- expansion revenue from existing clients

When investors are looking at a score above 1 - first of all, it's a good sign that you are quite efficient in scaling the company - though it's important not to lose sight that if its happening mostly due to strong revenue expansion, then company, in reality, has troubles on getting new client logos through the door. If it's only because of new bookings - there could be questions over net dollar retention and long-term product competitiveness. It's always a balance to make sure that both parameters are taken care of - then you are for sure in the green zone.

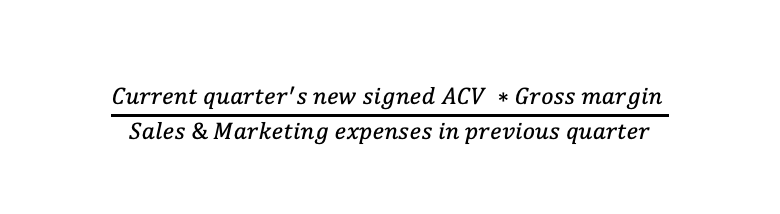

Bessemer's CAC Ratio

Similar to the concept of Magic Number, there’s a term called “Bessemer CAC Ratio”, where the formula is more defined to new-fangled acquisitions.

CAC stands for Customer Acquisition Cost and is one of the fundamental metrics that SaaS metrics explore when they study key KPIs for a subscription business.

The ratio is calculated by observing the quarter over the quarter rise in gross margins divided by the total sales and marketing expenses for that particular quarter.

Gross margin indicates the entire revenue excluding the cost of the goods sold. If the CAC ratio is more than 1, then it’s time to accelerate your investment in sales and marketing strategies. If it is between 0.5 and 1, it showcases that your business is in a sweet spot and has the option of spending or not, contingent on the circumstances. Lastly, if the ratio is less than 0.5, then your business is in a difficult position and has not been acquiring potential clients effectively.

There are two key differences between the Bessemer's CAC ratio and SaaS magic number are:

- The presence of gross margin brings more comparability when measuring scaling efficiency of a recurring business with 30% gross margins such as most payments businesses with pure subscription businesses typically with over 75% gross margins.

- Focus only on new signed ACV, whereas SaaS magic number is about incremental growth of recurring revenue which is a function of both new signed ACV and up-sells from existing customers. As a result, Bessemer's CAC ratio doesn't take churn into consideration, which is highly important for any SaaS business.

Generally speaking, it's much easier to get a SaaS magic score of 1 then get the same bessemer's CAC ratio, they are equal to each other when there is no up-sells with 100% net dollar retention and no cost of goods sold, both of which are rarely the case.

Comparing SaaS Magic Metrics

When comparing the different SaaS Magic Metrics, it is worth mentioning that SaaS Magic Number is the most accurate metric for calculating sales and marketing efficiency for subscription businesses as compared to other methods like CAC (Customer Acquisition Cost) or LTV (Lifetime Value). Here’s the sole reason behind it:

LTV mostly benefits in measuring customer value over a period, which indicates the sense of the ultimate value of that client to the business over time. The challenge with LTV in SaaS is that the information for your business relating to purchase behavior isn’t quite robust, especially in the early days, when customer churn and up-sell patterns are unclear. At seed to A stage, there are little to no B2B SaaS businesses in the market that have adequate clients to make the numbers statistical significant on a monthly basis. When it comes to CAC, it is harder to accurately measure the results because sometimes in SaaS businesses it can be difficult to place those costs to what that new CAC is, as contrasting to up-sell or cross-sell within the same organization.

Conclusion

Start-ups and seasoned businesses are always advised to calculate the scaling efficiency metrics on a regular basis to determine the health of their business and not to lose track of the big picture. Plus, it’s also worth mentioning that when the Magic Number or any other metric is kept in isolation, one won’t ever be able to determine the overall health of the business.

It is also important to keep in mind that SaaS metrics operate and function effectively when used together. If your start-up’s magic number’s more than 1, then its great news but you need to make sure to calculate the payback periods, gross margin, churn LTV/CAC etc in turn not making it a lonely number in the long-run. Never get into "metric debt" by concentrating on just one particular SaaS metric. Whether you’re impacting your pricing strategies, decreasing client churn or boosting the free trial-to-client conversion rate, being mindful of SaaS magic number in the short-term will most certainly helps you stay on the right path.