MRR (monthly recurring revenue): the ultimate guide for SaaS

After writing this post, I found out that it has gotten a bit out of proportion, so below is a short table of contents:

Sections:

- Intro

- Metric vs Reporting (GAAP, IFRS)

- Definition: what is MRR (monthly recurring revenue)?

- Tracking MRR and why its important?

- How to calculate MRR and its growth rate?

- Who is accountable for MRR?

- Best practices for calculating MMR

- Ways to mitigate common calculation mistakes

Intro

The health of any SaaS business by definition requires to have a consistent subscription revenue. The key metric to well- being of a subscription business is the most famous "MRR", or "Monthly Recurring Revenue" metric.

After looking at over a hundred SaaS deals in detail I noticed that despite the MRR metric being a rather a basic one, over half of the companies foe multiple reasons don't get it right.

I will cover the common mistakes later down the road.

Metric vs Reporting (GAAP, IFRS)

There are over 1 trillion dollars in market capitalization of SaaS companies, yet MRR metric still isn't part of either GAAP (Generally Accepted Accounting Principle) nor IFRS (International Financial Reporting Standards), meaning there is a lot of room for maneuver is eyes of the founder when presenting numbers to existing or prospecting investors. The worst part is when CEOs aren't even aware of misrepresenting the information and making the management decisions without accurately understanding the financial picture.

Definition: what is MRR (monthly recurring revenue)?

In short, MRR stands for Monthly Recurring Revenue. The MRR metric measures the amount of recurring revenue that a company generated in a given month. In essence, monthly recurring revenue is one of the most trackable metrics out there for SaaS companies. Reviewing it on monthly basis basis allows understanding the key trends in the subscription business.

The most basic example for MRR formula is pretty straightforward:

Monthly recurring revenue =

# of paying customers * average recurring revenue per customer

So, 50 customers paying on an average $500 a month would yield MRR of $25k

Tracking MRR and why it's important?

SaaS companies must track their recurring revenue for a couple of main reasons:

- Understanding the current company’s growth trajectory

Whether you are running to run a venture-funded company and have to report revenue to your investors on a monthly basis or bootstrapping it - it’s important to know where the business stands at any given point. MRR is a clear metric for a SaaS company to account for and its growth on a month over month basis shows whether you are about to win a race track or still harnessing the horses. Below is some advice on making sure you are doing everything towards winning a race track.

- Have a clear scalable framework to forecast and plan accordingly

A recurring business model is the core monetization strategy of any SaaS company by its definition. To accurately plan and project where the SaaS company will be in 6- 12-, 24- months, management should have an explicit methodology on how to transform its bookings, invoice, discount. As the company grows, if early methodology mistakes pile-up - the management is the one who is going to get hurt the most.

Or simply put:

“If you cannot measure it, you cannot improve it” – Lord Kelvin

MRR growth calculation methodology:

Before diving into the MRR growth formula, let’s review the step by step process, consisting of several steps.

To calculate monthly recurring revenue, one should:

- Normalize the data

- Segment the customers

- Add up the MRR figures by segment

- Calculate MRR growth

1. Normalize the data

The process is pretty straightforward:

- Each Customer ID should represent its own row

- In the next column should be their subscription value

If subscription is not monthly: divide multi-period contract value by number of months to get to a normalized value of the invoice - Next 2 columns are (i) invoice payment date and (ii) repeat rate

To put it into perspective, consider a SaaS company with 20 customers:

- 10 customers pay $500 on a monthly basis

- 5 customers pay $7k on a quarterly basis

- 5 customers pay $20k on an annual basis

Monthly MRR would be = 10 * $500 + 5 * ($7,000 / 3 ) + 5 * ($20,000 / 12) = $25 000

Dynamic excel template for normalizing the MRR data

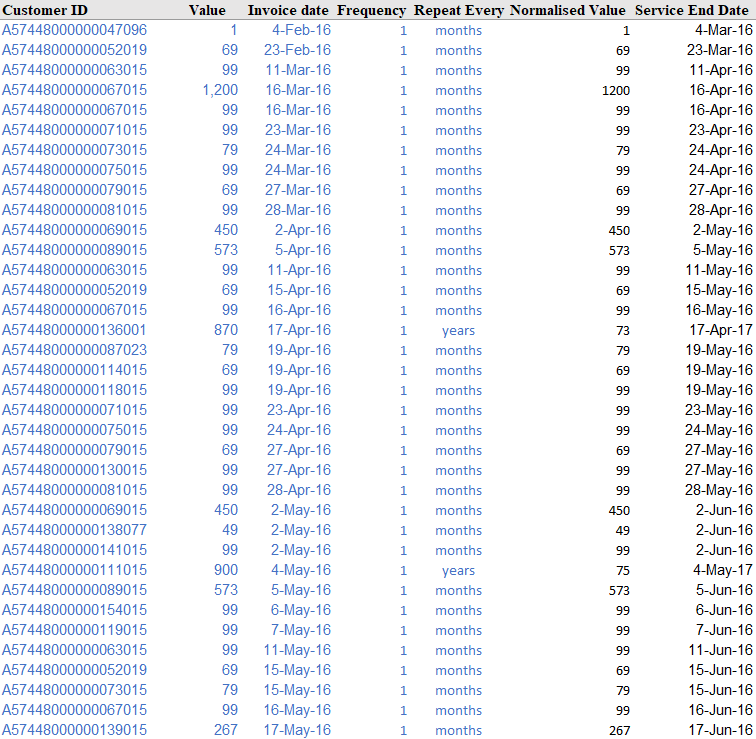

Let's normalize a real-life example. In the template above there are 15k invoices with 5 input columns: Customer ID, Value, Invoice Date, Frequency and Repeat rate of Invoice.

First, let's normalized the invoice data across different time intervals.

Secondly, we can create a table of all the data across all customers which will look something like this and is much more digestible.

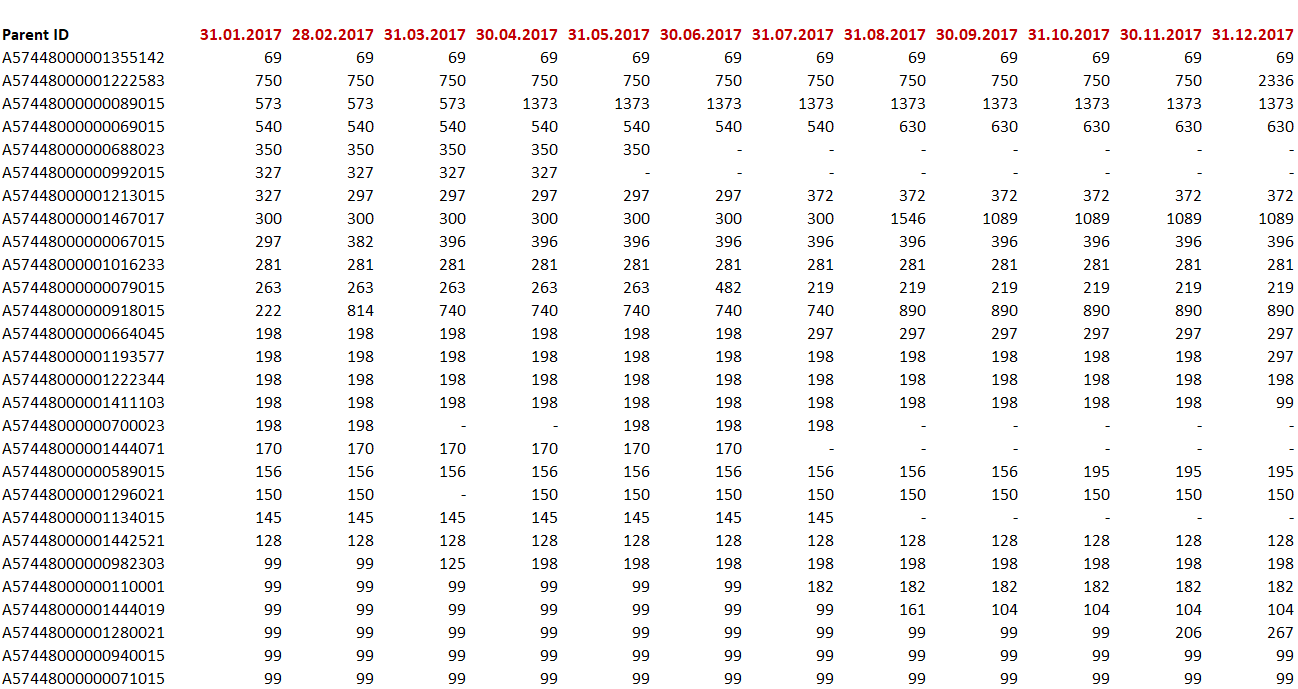

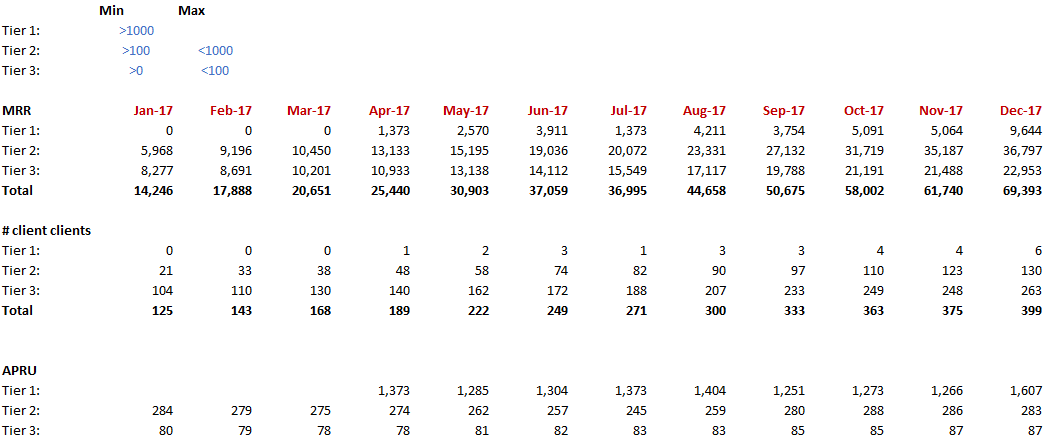

2. Segment the customers:

Having one group of customers is often not very resentful. Small businesses usually behave very much differently than larger mid-market and enterprise customers. To access the lower-level information, we would need to set-up some filters by pricing plans or total monthly revenue client generates and calculate the total MRR metrics based only on the specific segment.

My approach usually has 2 or 3 tiers of customers and setting up a threshold between them to have a half to one order of magnitude in pricing between the average per tiers.

An example would be:

- Tier 1: >$1k / month [aver. ~$1.5k ]

- Tier 2: $0.1 - 1k / month [aver. ~$500 ]

- Tier 3: <$200 / month [aver. ~ $100 ]

For more deep dive into customer segmentation with cohorts analysis in excel template here. The post will help you get a better understanding of what is happing inside each customer segment with respect to MRR from new clients, net expansion and churned.

3. Add up the MRR:

Just add the MRR figures per each segment to get a total monthly recurring revenue.

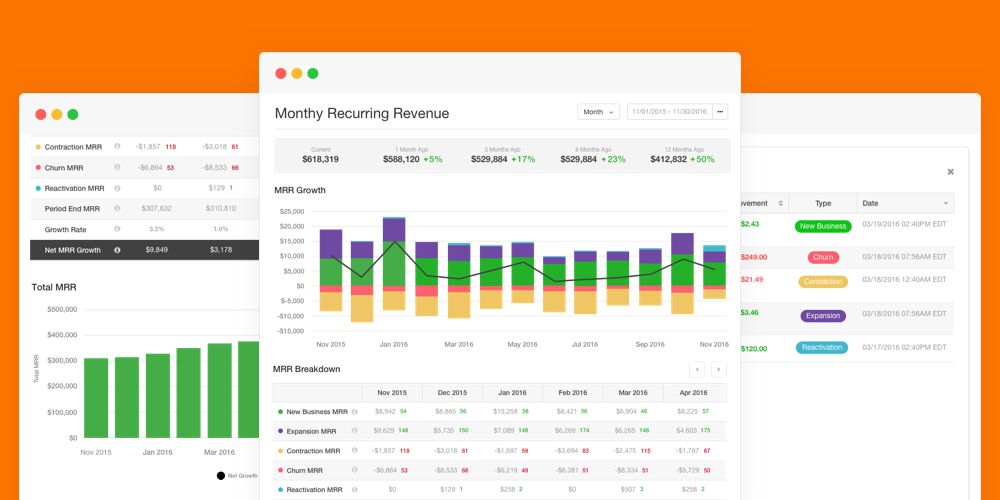

4. Calculate MRR growth

MRR growth formula has few components to it:

- New MRR - the amount of new business company generated last month

- MRR from Net Add-ons:

(+) MRR from expansions

(-) MRR from contraction - Churned MRR

Total MRR = End of Last Period MRR + New MRR + Net Add-ons - Churned MRR

As the business grows and client usage pattern emerges, it gets vital to track all 3 components to understand what are the key drivers behind the growth.

Usually, when growing from 0 to $100k in monthly recurring revenue, new MRR is the key metric that will drive the business, as the low base doesn’t impact that greatly towards the overall MRR figure.

Growing beyond $100k typically entails having a net dollar churn, meaning Net Add-ons - Churned MRR should be positive, otherwise the recurring revenue metric very soon will saturate and business will stall. Detailed analysis on this topic we’ll cover time else.

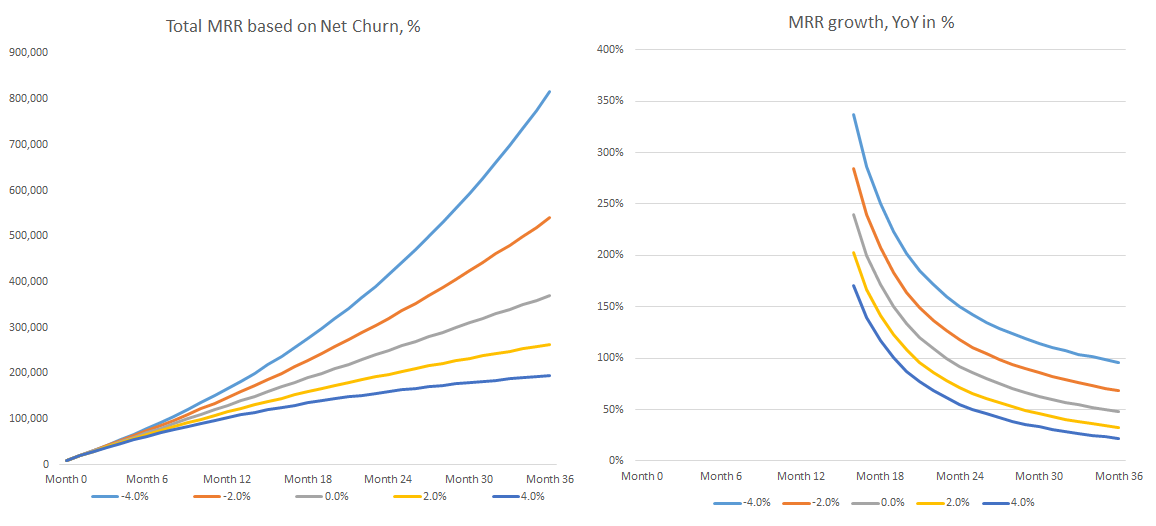

Here is an example of a company with a steady inflow of $10k of new MRR based on different Net Dollar Churn % which is calculated as (Net Add-ons - Churn MRR)/Total MRR

We can see a huge difference in the -4% vs 4% net churn scenarios. The total MRR in 3Y with constant addition varies over 4x. Moreover, the growth rate in case of negative churn of -4% can be still maintained at above 100% till month 36 even with flat new MRR additions, whereas for a business with high monthly churn it basically flattened at $200k at the same period.

Who is accountable for MRR?

Although it's sound as just a financial metric, there are a few roles inside a SaaS company who are held accountable that MRR growth:

- Product team: better product allows the company to retain customers or prevent the Churn MRR part.

- Sales & Marketing team: New MRR is what the sales team is responsible for.

- Customer success: Net Addon’s is the target component - expansion and contraction typical success team customer

- Finance team: coordinating the Sales, Product and Customer team to impact the growth of the company and held accountable to their relevant potion.

Often MRR metric is a north star metric to get from one phase to the next one, specifically when raising early-stage capital and there are definitive MRR based proxies where should the company be in order to raise its next round of financing.

Best practices for calculating MRR

1. Normalizing paid invoices

Key mistake: forget to divide a multi-period contract by its contract length to get a single month value.

MRR is a monthly metric, often acts as a recognized revenue as well. MRR is not cash or bookings. It measures the company's efficiency during each month and how quickly the company grows.

2. Show the full value of the transaction

Key mistake: exclude transaction fees and present net of fees recurring revenue.

Although it’s often prudent to be conservative, clearing out the transaction fee is actually not correct. Transaction costs are part of the costs of running a business, meaning they would typically show up in the Cost of Sales part of the profit & loss statement of the company. Acquiring or transaction costs usually vary across the payment vendors and although they are never 0%, there is some room for optimizing and improving your overall gross margins.

3. Exclude any one-offs (ex: setup-up/onboarding cost)

Key mistake: to include non-recurring revenue items into the mix.

MRR metric by definition only includes recurring revenue, so any setup-up fees would only inflate the overall revenue number and skew the results. Moreover, such a win is only temporarily and already in the 2nd month it would show churn causing even more distortion in the retention.

4. Exclude any non-paying accounts

Key mistake: to include free trial users as already won customers.

From the marketing perspective, there are often situations where it makes sense to have a 0-touch sale. Many times, though, it’s not a freemium product, but a free trial with a limited 7-/14/30-day trial period asking the user to provide his credit card to get past the paywall. Conversion to paid customers after a paywall is never 100%, meaning measuring MRR based on the user that sign-up their credit card is just plain wrong.

5. Exclude any discounts

Key mistake: record pre-discounted sales.

When a SaaS company just starts selling its product, to incentive buyer’s conversion it would often provide a discount for the first 1-/3-/6- month to new customers. If by doing so the company posts its MRR without deducting the provided discount, it again overstates its revenue. CEOs of early-stage companies often argue that in a short time they would go into full pricing mode, however, the correct thing to do here would be to show an expansion MRR after discount is off, rather than misrepresenting the figures at first.

Many times VC investors make are forced to make quick decisions based on high-level information provided by the management. However, these types of errors are always found at the due diligence stage and typically break the deal apart, significantly affect the repricing of the deal and create distrust among the founder and the investors.

A live-story example:

One of the early-staged companies we worked with stated that it has $400k ARR from 15 customers, meaning around $33k MRR. While doing the due diligence it was revealed that:

- 10 out of 15 customers had a 25-50% discount for the 1st year of the contract for being design partners

- 5 out of 15 customers had US$5-10k setup-up costs backed into recurring revenue figures

As a result, marking actual MRR around $17k (~50% of stated numbers) crippling our trust in the founder.

Ways to mitigate common calculation mistakes:

- Automate MRR calculation using software tools

There are quite a few solid tools in the market, such as Profitwell, Chartmogul, SaasOptics, etc. The software vendors usually triple check their MRR methodology as their client entrusted them upon it. - Higher a third-party CPA accountant

Have your numbers checked by a trusted professional accountant that was worked with SaaS companies is always a prudent idea. Accountants always turn-on their scrutiny meter when reviewing other's numbers.

To summarize:

Though MRR is one of the most powerful SaaS financial metrics, it’s important to lose sight of it for all team members, as almost everyone inside a SaaS company has the ability to influence it. Most importantly, despite that it's not a part of official accounting principals - my advice would be to keep the temptation to artificially tweak it under control.

As always a few links to follow-up more on the topic:

If you are an early-stage founder with north of US$50k in MRR looking for funding - please send me a message to chat: anton@flashpointvc.com

Cheers,

Tony