ABOUT TONY FEDOROV @ FLASHPOINT

Greetings Reader,

I'm a Partner at Flashpoint VC, an early-stage investor focused on Emerging European and Israeli founders in their pursuit to build global software businesses. We aim to be true partners to our founders and assist them with hands on approach from data analysis to building financially prudent business models to insights in scaling sales, marketing and HR.

The articles I write for this blog is yet another tool we hope founders can employ to jump start their companies and overcome scaling endeavors you encounter.

Thank you for reading, and I hope you find some value. If so, I'd highly appreciate it if would you subscribe below or share it within your network.

SUBSCRIBE TO NEWSLETTER

Please fill-in your email address to become a reader of this blog and receive notifications of new posts by email.TO CONTACT ME

anton [at] flashpointvc.com

FOLLOW ME

Anton Fedorov

- Venture Capital

- 3 min read

If VC would've been a sport - it would've been Baseball

It's a pretty popular fact that greatest baseball players hit the ball every 1/3. The green line below show this as fairly consistent across the top-50 hitters historically (the 50th having 2839 hits, so it's quite reprentfull). While the greatest hitters do an average 15-20%

6 years ago

- SaaS metrics

- 4 min read

What does the Rule of 40 tell about a SaaS company?

The Rule of 40 emerged a few years back at a time when many SaaS companies started to go public. Unlike traditional public on-premise incumbents, SaaS companies do not repay instantly the customer acquisition costs (CAC) and require at least 6-12 months of payback period to recoup it. Capital markets

6 years ago

- SaaS metrics

- 9 min read

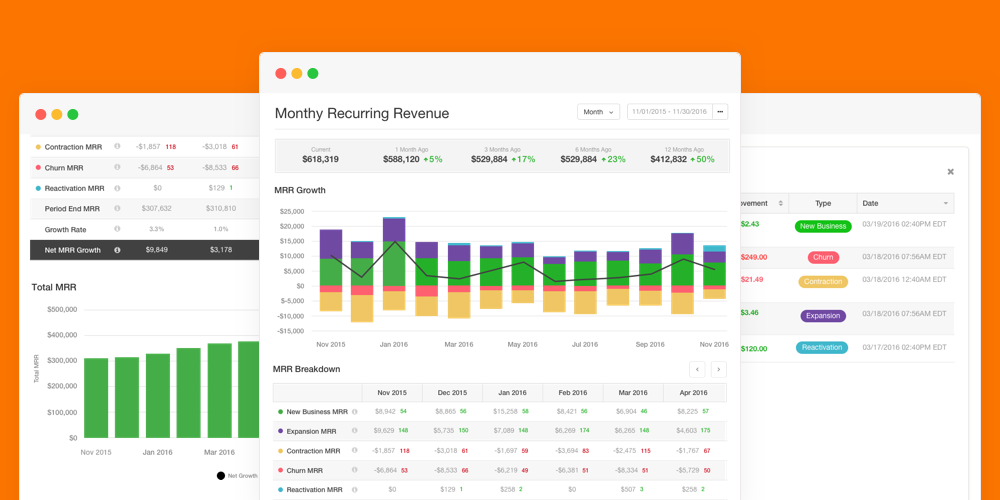

MRR (monthly recurring revenue): the ultimate guide for SaaS

After writing this post, I found out that it has gotten a bit out of proportion, so below is a short table of contents: Sections: * Intro * Metric vs Reporting (GAAP, IFRS) * Definition: what is MRR (monthly recurring revenue)? * Tracking MRR and why its important? * How to calculate MRR and its

6 years ago

- IPO

- 17 min read

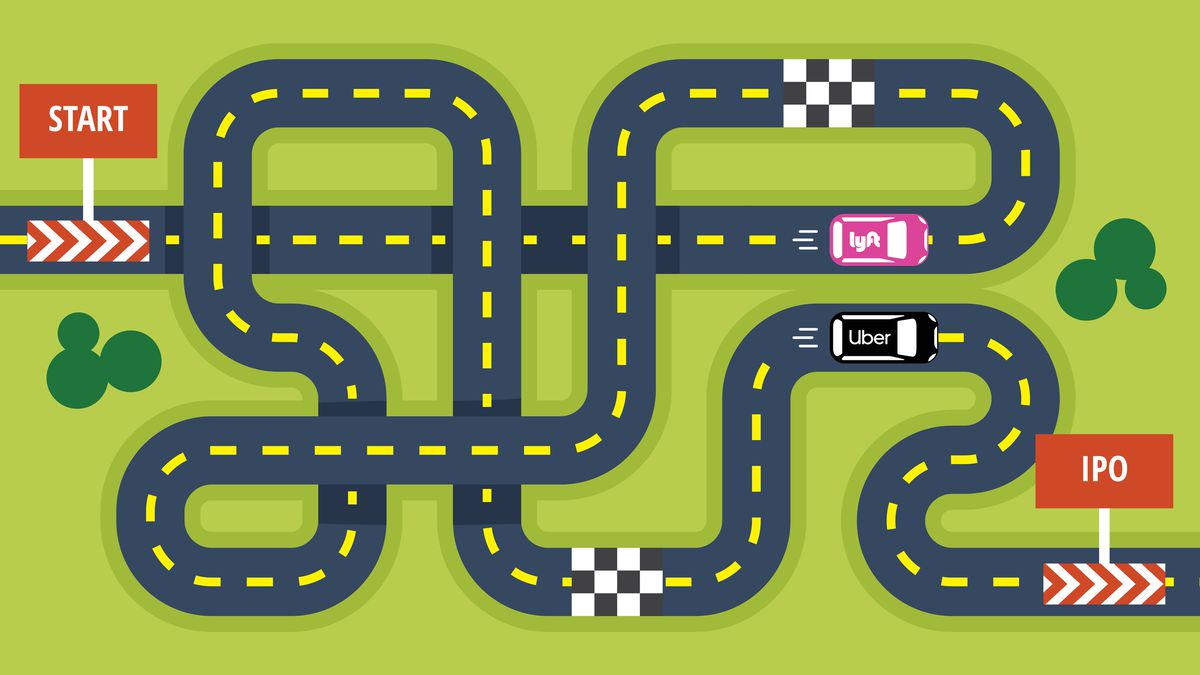

Lyft IPO valuation: a US$20bn rideshare

Every IPO has a story, especially in the consumer technology sector. This one is a tale about bad and good, black and pink, uber vs lyft. Unlike many other markets, the ride-sharing market due to original huge fragmentation and regulation was significantly underlooked. Since 2010 when Uber and then Lyft,

7 years ago

- Venture Capital

- 2 min read

Long live the Content - long live the King

At the foundation of any organization, there are a few elements that repeat over and over regardless of the industry. * Team or who does what? * Process or how they do it? * Content or What they do? * Vision or why do they do it? (other than to make a buck) With

8 years ago

- Startup Templates

- 6 min read

Nail it then scale it: growth vs CLTV-CAC excel template

Despite all available resources (tons of open-source, cloud IaaS, testing tools etc) it is still much harder to build a SaaS than a marketplace. With marketplace to start getting first traction all you need is a few landing pages, an advertising budget for facebook / google, if there is a need

8 years ago