ABOUT TONY FEDOROV @ FLASHPOINT

Greetings Reader,

I'm a Partner at Flashpoint VC, an early-stage investor focused on Emerging European and Israeli founders in their pursuit to build global software businesses. We aim to be true partners to our founders and assist them with hands on approach from data analysis to building financially prudent business models to insights in scaling sales, marketing and HR.

The articles I write for this blog is yet another tool we hope founders can employ to jump start their companies and overcome scaling endeavors you encounter.

Thank you for reading, and I hope you find some value. If so, I'd highly appreciate it if would you subscribe below or share it within your network.

SUBSCRIBE TO NEWSLETTER

Please fill-in your email address to become a reader of this blog and receive notifications of new posts by email.TO CONTACT ME

anton [at] flashpointvc.com

FOLLOW ME

Anton Fedorov

- Venture Capital

- 1 min read

Thoughts on VC's DNA

Yesterday, there was a good post from Steve on Hackermoon on what are good traits of a VC. Here are my few lines on the topic. Beyond qualities of being an insightful and knowledgeable folks whom its good to work with, here is a short of list of qualities which

8 years ago

- Scaling

- 2 min read

Mastering enterprise software sales for early-stage companies

With the commoditization of marketing channels (search, social, display, etc) within a handful of platforms - paid marketing de facto became a commodity. Not to say there is nothing to do in marketing anymore, but getting first leads though might be costly, it is not the main challenge. Doing first

8 years ago

- Venture Capital

- 8 min read

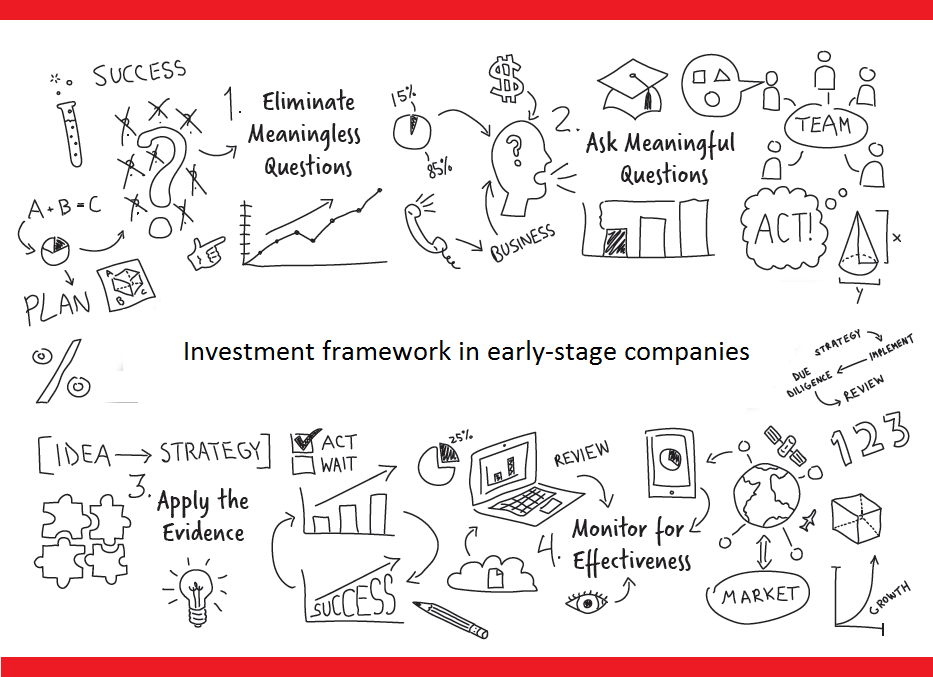

Early-stage startups investment framework

After having been pitched thousands early stage companies makes sense to share the investment framework, which we used to streamline investment analysis and be more diligent and thoughtful about our investment process. Early stage startups, especially now in IT operate when a cost to create a company is almost reduced

8 years ago

- Venture Capital

- 5 min read

What does a limited partner look in a venture capital fund manager?

The venture capital's business model is to invest into and sell companies, making several times in the process. To fund an investment, venture funds rely on its limited partners for their capital. There are many types of organizations and individuals who are pertained to fund risks imposed by

9 years ago

- IPO

- 2 min read

Sharp fall of snapchat stock after first earnings report (2017Q1)

After a quite nice stock market euphoria in February almost reaching 2400 in S&P Snapchat successfully caught its ride, while placing its stock at US$17 per share and soaring ca. 40% on the first trading day. Yesterday, Snapchat released its first earning report and in the aftermarket

9 years ago

- Venture Capital

- 2 min read

3 types of transactions in venture capital

Venture Capital is a complicated business with a lot of things on its plate. However, yesterday, during our team dinner one interesting idea was circulated by Michael that can simplify what venture capital is all about. In most business, there are usually 2 types of transactions: * buy services of a

9 years ago