Early-stage startups investment framework

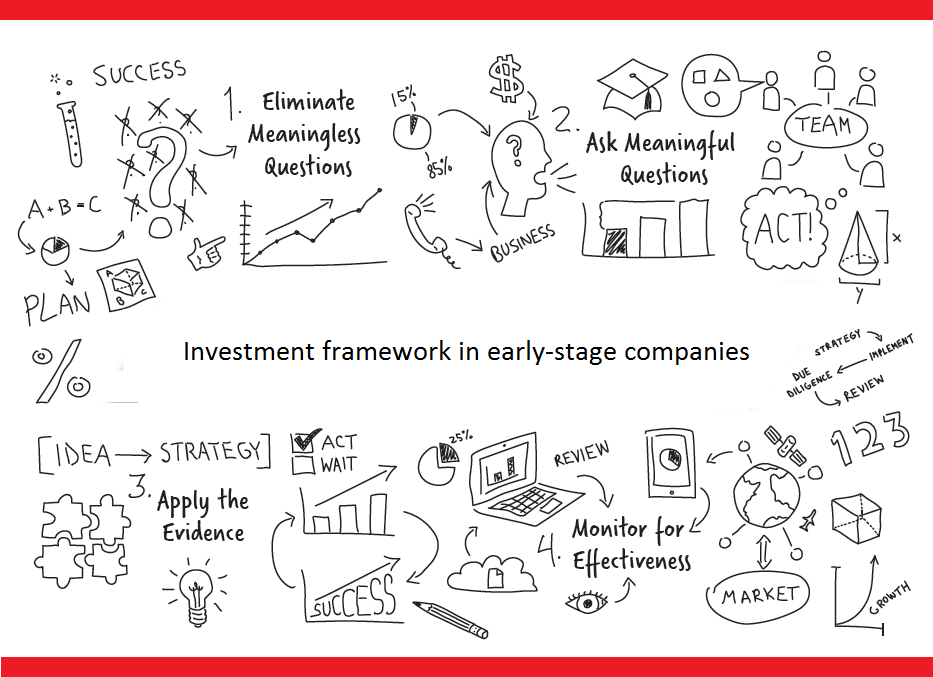

After having been pitched thousands early stage companies makes sense to share the investment framework, which we used to streamline investment analysis and be more diligent and thoughtful about our investment process.

Early stage startups, especially now in IT operate when a cost to create a company is almost reduced to zero. Bootstrapped startups look very much like an amoeba, constantly working under pressure from all sides: constrained marketing budgets, at war with tech giants for R&D talent, fight among themselves for more capital and PR trying to grasp its product market fit.

Our job as a post-seed / Series A VC is to try to quantify such risks and to make calculated bets on the founders and market trends which are positioned to show superior growth. Coping with different types of risks requires taking emotions out of the equation and having a sound framework.

Here is the summary presentation, in much detail you can read below:

A high-level 5 question framework we evangelize in-house is based on 5 components a startup:

-

Is founder's team an A-level one? (serial entrepreneurs, multiple founders, cash contribution, domain expertise)

-

Is there enough muscle in the company? (business model, traction, product market fit)

-

Is there an opportunity to create a large company? (market, competition, defensibility / entry barriers)

-

Is there an opportunity to return a >10x? ( successful previous exits in industry, good deal terms)

-

Is the chance to create such returns is high or how to hedge risks? (negative protections, liquidation preference, and liquidation value)

The devil as always is in the details, so let's go over them in details:

1. Founder's Team:

So what are looking in founders as we get to know them during their start-up pitch and with some of it during due diligence phase?

-

Integrity: VC investments have a great deal of asymmetry of information between founder and an investor. Many decisions VCs take are made solely based founder's forward-looking assessment of current situation. Just like in any marriage, maintaining trustworthiness and fair-dealing between entrepreneur and investor is key to a fruitful relationship for years to come.

-

Passionate vision: Venture investing is a marathon, not a sprint and future is always blur. Seeing the end game for founders and CEOs is an essential skill, as key team members also must be aligned with founders to commit themselves for the long run.

-

Experience: Any company hits many icebergs along the way, that is why VCs like serial entrepreneurs. Outstanding results usually happen within experienced teams who know how to prioritize and already learned their mistakes with no need to repeat them. So even if previous startups were not a huge success, building a company from scratch has a tremendous benefit.

-

Leadership: The job of an entrepreneur is to surround him(her)self with smarter people so together the team can overcome any obstacles along its way. Without founder's leadership skills, the company will never flourish and scale.

-

Risk-taker: VC by definition is a risky thing to do, but if the founder does not experiment on most of the variables he can within reasonable budget, he will beaten by someone who is, I personally like facebook's moto "break things, move fast". Best inventions were achieved through significant trial and errors.

-

Commitment: The are two types of commitments: financial and a time one.

Cash injection by the founders is one of the strongest litmus tests whether the founder believes in the company in the end. Venture capital ain't cheap money, so if the founder does not put to the line his own savings (or at least part of it), it only strengthens information asymmetry between himself and the investor.

Time and momentum are the rarest resources the founder have to spend. Founders dedication to the company is the sole factor for a company move a "0" to a "1" state. If an early stage company is not the sole priority of the founder for some time before he met us we would pass.

Related posts:

2. Business specifics

When analyzing company we tend to split our analysis into (1) product and engagement metrics and (2) business and financial Metrics.

Product and engagement metrics:

-

User engagements: Clients (Downloads) / Active users

Every startups has its own definitions of what an "active” means. Some startups count simple logins to the service, while others include only significant user activity such as several key actions were performed.

In the world of social, investors want to see meaningful product engagement use such as ten's of minutes (not seconds), ideally expressed as strong cohort retention on metrics that matter for that business — for example, DAU (daily active users), MAU (monthly active users), rooms booked, photos viewed/rated, and so on.

For mobile apps, a good indication is to analyze ratio of DAU / MAU. Facebook, for instance, has figure in range of 60-78%, depending on region, where as for mobile games from developers such as King or Zynga have ratio around 25%.

For SaaS products, a ratio DAU/WAU (WAU - weekly active users) ratio below 20% would probably mean the product is used 2-3 times a week at most, and such clients might not use the product as a must and have a high chance to churn away.

-

Month-on-month (MoM) growth

Venture Capital investing is based around engagement traction and growth. Not only we prefer for month over month grows to be positive, but for company to grow >10x in revenue in 4-5 years, it usually mean company need to maintain monthly growth rate above 10-15% for first 12-18 months.

-

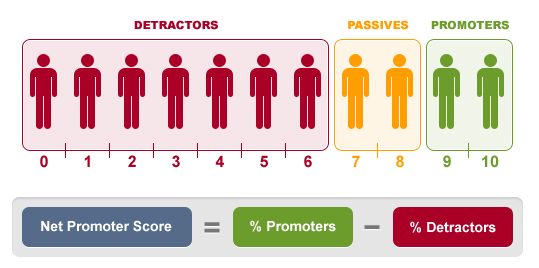

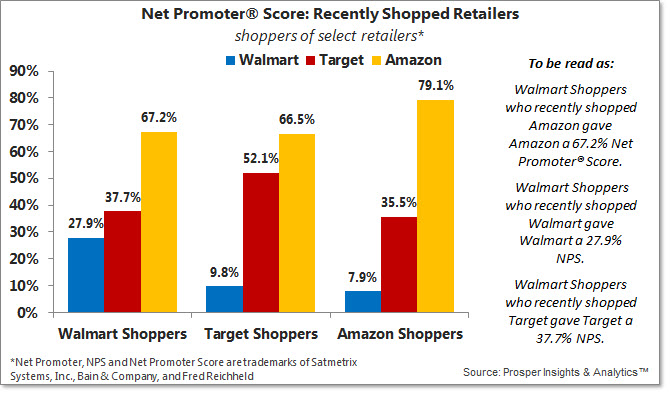

Net Promoter Score (NPS):

Though it might a bit old, NPS score gives a good estimate about how strong is the core user base:

Generally, we are interested in companies where clients give product an NPS above 50%. High NPS score usually translates into low churn rate.

Here is an example on how different NPS score for Walmart and Amazon shoppers.

-

Cohort Analysis / churn:

One of key product metrics is churn. An ideal founder know how customers use his/her product: both when a customer decides to leave and how to foster an upgrade.

To quickly perform cohort analysis, calculate churn and estimate LTV we use Cohort analysis template in excel

Monetization Business and Financial Metrics:

-

Value foundation: in essence, it's a combination of gross margins, ratio of LTV / CAC and R&D technology barriers to entry.

-

monetization: there are only 3 types of transactions to monetize:

- banner advertising per view/click

- transactional revenue per sold product

- recurring revenue.

In almost in every vertical, the earliest of companies to employ scalable Value foundation emerged to be a giant business with billions in capitalization. Recurring > transactional > banner

Related posts:

3. Market opportunity

- Everyone in VC is looking at TAM / SAM / SOM. But what we don't like is when founders:

-

present their niche as intersections of huge markets, most likely it will mean there's no zillions of uptapped demand for such product/service. One should know his true strengths, even if he operates on a smaller market today and should create local monopolies.

-

expand SAM by aiming to go international before they monopolized the local market. Only monopolies create value that withstand time.

-

attack traditional billion dollar industries without superior go-to-market strategies (very rare we agree that pricing is the one). There is nothing wrong about traditional business, but to withstand existing crowded competition with same approach would generally mean higher CAC and much worse unit economics.

- Competition / Industry

We very like fragmented industries (such as restaurants or hotels). In such industries clients enormous pressure from their next door piers to stay alive and they thrive the opportunity to get better (thus a least try your software). Whenever someone is trying to build a service on top of facebook or some other dominant platform (excluding apps) most likely their margin sometime down the road will be squezed, better be prepared to diversify platform risks or just die quickly.

- Why now timing.

This is probably one of the hardest questions to answer as you can only back trace in few years time. One good indicators if your startup is the a derivative of another huge trend or ther is a major gap in the market (big delta between what is available and what is possible). One good example was given by Aaron Levie, founder of Box.com when he started in 2005:

- 8x storage efficiency from '00 - '05 at same prices due to Moore Law

- Globalization and remote workforce (working from both home and work)

- AJAX with modern browsers (firefox)

- Increasing bandwidth due to broadband

Related posts:

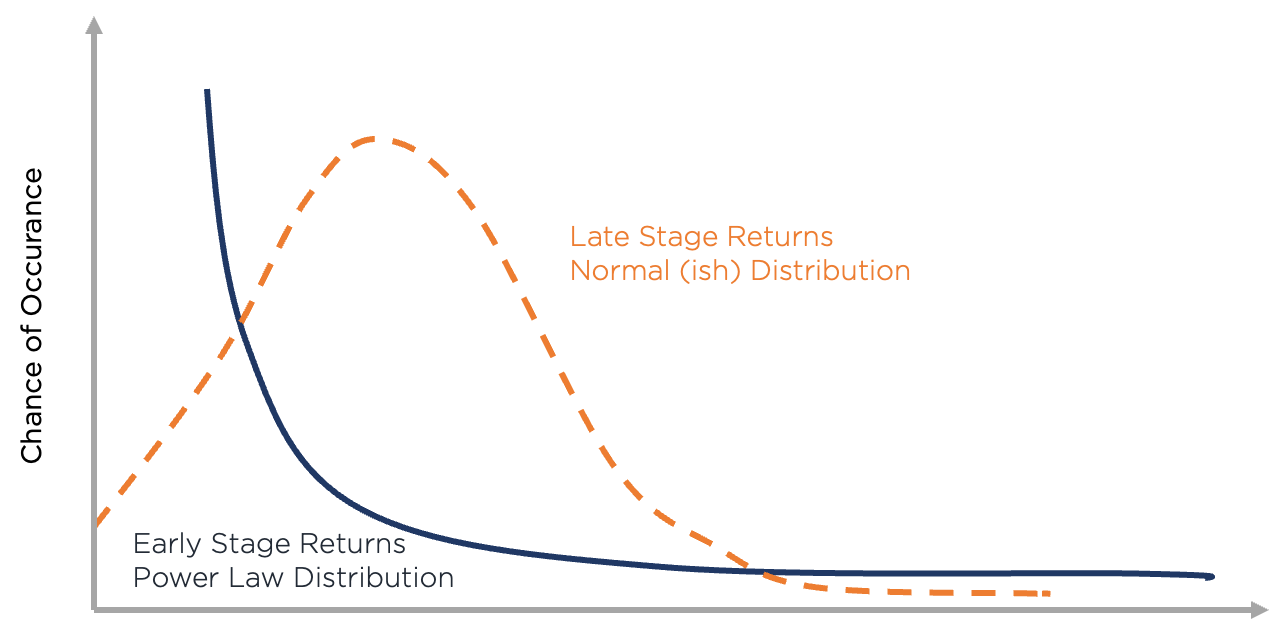

4. 10x exit opportunity

There are a few approaches here and it all depends how much capital you have and what's the fund's strategy. "Spray and pray"'s strategy is different from one where investor's is more selective and only invests if they a board seat is available.

But at the end of day any VC was born to make meaningful returns to their investors to roll capital into the next fund. With general hurdle rates at 8% per annum, with average typical holding period of 8 years, that's about 85% upside to deliver just to start making carry (aka part of profit upside).

Key questions we tend to worry about are:

-

Exit environment:

-

diversity of buyers to create a potential auction (which is the only way to increase price). IPO's are an ideal way to exit (free market is the best auction), but M&A is probably the most likely scenario.

-

sustainable financials in the future. (EBITDA margins >20%, Gross margins >50%) This gets very true if you are a picky investor and the possibility to sale your stake to another financial investor up the food chain is very essential)

-

-

Deal parameters:

-

Entry valuation. Having so much of asymmetry of information, the only thing an investor is the initial price per share. There are other items such as liquidation preference which can slightly vary the distribution pattern, but you don't control when the investment will get liquidity and neither do the exit price (with overfunded startups it might be the case as board will start to consolidate more power than CEO after 3 or 4th round of financing, but as an early stage investor you might be out of the board anyway), for that reason we don't do unpriced deals (vs revenue or vs amount of capital and previous capital raised)

-

Deal structure. On occasion the bid and ask spread is just to wide to mitigate, we can get creative and introduce ratchets and clawback, but over time we found such scheme create much confusion and skewed relationship between founder and the investor. Ideal situation is caped convertible or a straight equity with 1x + single digit non-participating liquidation preference.

-

Healthy cap tables. Every situation is different but in some cases pivot are inevitable part of company's storyline. Usually this would mean founder raised either capital at inflated valuations or raised too much capital. At an early stage if the founder control less than 50%, very quickly board will want to consolidate more power and start looking for a quick buck if thing don't shoot through the sky. Giving to founder an additional Founder's ESOP is way to solve this problem.

5. Risk mitigations

It is hard to control the downside, but few tips on how to control the downside:

-

Recognize failure early: even though it is definitely not what founders would like to hear from their partner, but as a fund manager funding a persistent loss can create excruciating consequences for the whole portfolio pretty quickly.

-

Strong minority rights: this will usually comprises of some or all of the following (depends of the amount you invest):

- information rights and/ or a board seat

- reps, warranties and indemnities

- covenants, pre & post-closing conditions

- anti-dilution provisions

- liquidity rights (tag, drag, RORF, Change of control and transfer provisions)

-

Liquidation preference > hurdle rate. VC's money are highly expensive, so incorporating the cost of capital into the investment itself is a safe way to offset part of the carry economics.

The only real levers a VC can have are funding schedule and its triggers, ability to change top-management changes through the board and force a default or an exit (if board control the company).

Related posts:

- When things don't work out, by Fred Wilson

Those are just the basics, but at least for now seem to be working pretty well.