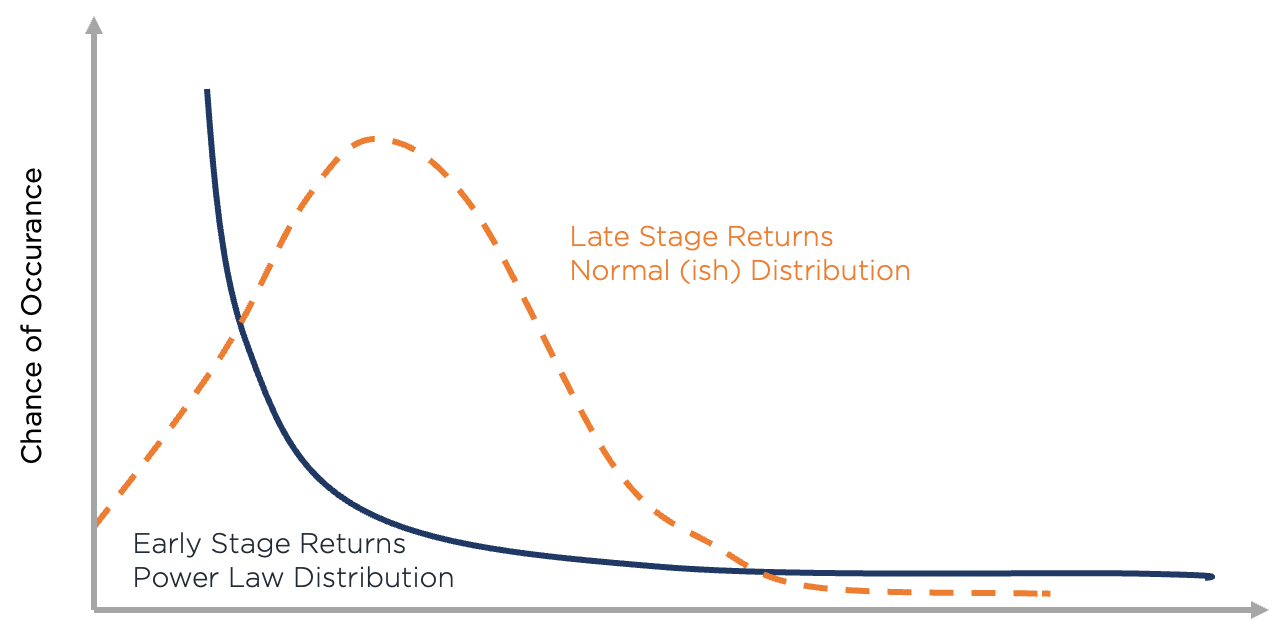

Power law and implications for portfolio management

Unlike the stock market, where a Gaussian distribution with fat tails more or less describes the return outcomes, the distribution of returns in the venture world is subject to exponential distribution (The Power Law). Namely, less than 10% of capital drives typically 50%+ of fund returns and more than 90% of fund profits.

The 10x rule

The goal of any VC fund manager is to invest in a company that will return more than 10 times the invested capital. If you have a concentrated portfolio (that is, the share of each portfolio company in the size of the fund is ~10%), then one such transaction can return the entire fund.

In practice, for a Series A investor who invests typically around $30m post-money, 10x the money excluding dilution from future rounds and ESOP (employee stock option pool), it would imply the manager would need to sell the business for $300m (which in itself is no lot a trivial task). Taking into account between 2 and 4 rounds of dilution including ESOP (each of which is usually 15-25%), it will require a valuation to grow to $400 - 600m. Because it's not a simple task, someone even gave a term for it "soonicorn".

But if the fund manager gave only 2% of the fund to such a company, then it would only return 20% of the fund, and to return the fund in its entirety, the company either needs to become a multi-billion valuation company, or there must be several similar businesses in the portfolio.

On portfolio management and allocation

Portfolio management: the "ugly" truth

Where should the manager spend his(her) time when one realizes that (s)he has soonicorn/unicorn in the portfolio?

As a rule, if the business flies, then it does not need operational assistance; the contribution from any 1 person is completely offset by the fact that the company typically hires 50-100 people per quarter and management simply does not have time to work apart from board.

Portfolio management though is very much required in those companies that by themselves cannot get through product market fit or scaling and the manager has three options:

- roll up his hands and look for ways to correct the situation: calls/meetings with management, search for operational advisors

- give up and let the company cope on its own

- actively look for a way out to return original capital.

The last option is a rather complicated process, especially if the company has not yet grown into the $10m in ARR (annual recurring revenue), while the second option is how spray & prey funds deal with it since in a portfolio of 50+ companies there is simply no time.

Fund managers hope for the best and sometimes founders do surprise, but overall that's why the ugly truth when asking the founders if VC funds add value help - the predominate answer is they don't, unless the fund has platform support or fund partners built an emotional connection with the business/founder.

Capital allocation: asymmetrical returns

Another matter though is how fund managers behave when it comes to investing in follow-on rounds, the situation is just the opposite.

No one wants to invest in a shaky business without a clear growth trajectory; it rarely leads to success. On the other hand, all funds try to focus as much as possible on the winners, and you have to work hard to get an allocation in the next round.

For example, if you look at the history of UIPath: brand funds like Accel and Sequoia took almost the entire allocation of Series B and C rounds with several pockets of affiliated funds ending up taking the rounds (extract from IPO prospectus):

- Series B participation: Entities affiliated with Accel Partners: Accel Growth Fund Investors 2016 L.L.C., Accel Growth Fund IV L.P., Accel Growth Fund IV Strategic Partners L.P., Accel London Investors 2016 L.P., Accel London V L.P., Accel London V Strategic Partners L.P..

- Series C Convertible Preferred Stock Financing: Entities affiliated with Accel Partners: Accel Growth Fund IV L.P., Accel Growth Fund IV Strategic Partners L.P., Accel Growth Fund Investors 2016 L.L.C., Accel Leaders Fund L.P., Accel Leaders Fund Investors 2016 L.L.C, etc. Securities whose shares are aggregated for purposes of reporting share ownership information are Sequoia Capital U.S. Growth Fund VII, L.P., Sequoia Capital U.S. Growth VII Principals Fund, L.P., and Sequoia Capital U.S. Growth Fund VIII, L.P.

If you caught your luck, hold onto it with all your might. This is where a lot of fund alpha is found: asymmetry of information regarding the company’s risks has disappeared, while the upside is still at large.

PS. Ping me at anton@flashpointvc.com if you:

- Run a software company

- Have 7-figure annualized revenue with growth

- Based in Israel / NYC

- Looking for Series A